Craftspersons/ Artisanal, Cultural, Creative Industry, Economics, Report, Evaluation, Monitoring

The GST Regime is Damaging, Not Helping, India’s Crafts Sector

Mastani, Meeta

October, 2023

Already struggling to survive and compete with cheaper machine-made goods, the added burden of GST compliance will decimate self-employed artisans.

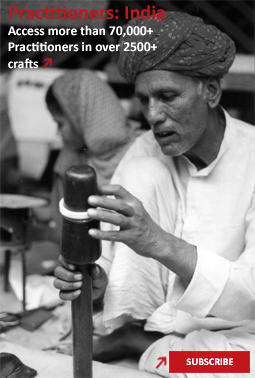

The cost of GST non-compliance is doubled when the formal economy refuses to buy from the local crafts industry. Credit: Meeta Mastani

The transition to the Goods and Services Tax (GST) regime was sold as a reform that would transform Indian industry for the better. Two months later, the plight of craftspeople across India tells a different story. Yograj lives and works in Kaziwala village in the district Bijnor of Uttar Pradesh. He makes small hand-made wooden items like juda pins which sell for about Rs 25 each. I live in Delhi and work with rural and semi-urban artisans like Yograj, providing them with design and marketing support. I connect them to urban markets directly, and also sell via a network of retail spaces I am a part of. His average bill with me each time is for about Rs 8,000. Over the year, his total billing with me is about Rs 50,000. His total annual turnover is Rs 1,80,000. He is part of a group of nine people. They are also tr...

This is a preview. To access all the essays on the Global InCH Journal a modest subscription cost is being levied to cover costs of hosting, editing, peer reviewing etc. To subscribe, Click Here.